Our last Probate Paths blog discussed the effect of death on community property. Today, we talk about another complicated situation involving marriage, another marriage, and death.

Sudden death, no will, and an outdated will…

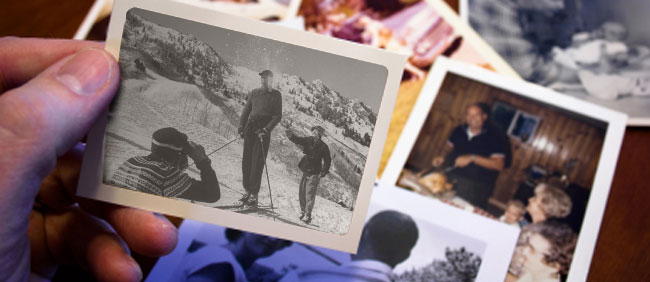

Hank and Dagny were happily married and living in the family home they bought together. Both had been married before and each had children from those marriages. Hank and Dagny died tragically in December in an avalanche while skiing in the Alps. Dagny never made a will. Hank left an old will in which his son Hank Junior and daughter Randi were the sole devisees. Hank’s will didn’t mention their current home or Dagny. The house is listed for sale by his probate.

What’s the Realtor® to do? And how would the title company approach it?

Download the Probate Path Flow-Chart

Click the image or link below to download a printable version:

Probate Path – Married, Separate Property Flow Chart.

Who passed away first?

Because they bought their house together it would be community property and under normal circumstances the surviving spouse gets it. Since it isn’t in Hank’s will it’s not part of his probate estate. However, it would be if Dagny dies before he does. But – how can it be established who died first – or even if either did? In this situation the presumption would be that they died simultaneously, but how does that help?

The three children could try to dispute who gets what, especially considering the house could be worth a lot and the rest of the estate might be quite substantial. Maybe they are all one happy family and agree that the house can be sold and the proceeds divided up amicably. Or – Alice might claim 100% for herself, arguing that Hank died first and her mom got everything. Hank Jr. and Randi might do the same. Definitely Hank’s will is going to be probated, and Alice will likely want to open a probate on Dagny’s estate as well. But, what if she doesn’t?

Separate property scenario

Here, separate property rules will be applied – to each spouse. The title company will assume that each estate will treat this situation as if each spouse had pre-deceased the other, odd as that might sound. As community property, on the death of either of them, the home would go to the other and would become 100% separate property of the surviving spouse. That rule applies to both spouses here, but then the separate property of each “surviving” spouse is dealt with. The title company would follow a separate probate path for each estate.

The potential interest of each of the three children (plus any other devisee identified in Hank’s will) must be addressed. “

If there is no probate on Dagny’s estate it would certainly call for a “lack of probate” affidavit where Alice gives the facts as she interprets them. The title would also rely on the facts that Hank’s probate will tell them. The potential interest of each of the three children (plus any other devisee identified in Hank’s will) must be addressed. During the pendency of a probate it would probably accept a deed from the personal representative based on an order of the probate court clearing the sale.

The appropriate probate path if Dagny had pre-deceased Hank

Let’s start with Dagny. If she died first, under community property rules Hank would end up with the house. For however many years (or in this case, moments) that he survives Dagny, the house is his, and Alice would get nothing when he died. Then, at the moment of his death, his will would come into play, and Alice would end up with nothing, because she could get only what Dagny would have gotten – but she was already dead and so couldn’t inherit. Junior and Randi get the house.

This is Probate Path No. 3 if his will is probated. If his will is not probated, it’s Probate Path No. 4. Of course, in the latter case, the title company would want a “lack of probate” affidavit, which would probably assert that he was unmarried at death. In that case, Alice would be out of luck. But, that can’t be applied for certain, because the order of death isn’t known.

The appropriate probate path if Hank had pre-deceased Dagny

Similarly, if Hank died first, then Dagny immediately gets the house. His will wouldn’t control. Again, for however long Dagny survives him, the house is hers alone. Then, upon her death Alice, as her only heir – Hank having pre-deceased her – gets the house. As noted, however, this rule can’t be applied because no one knows who died first.

Assuming that both spouses have pre-deceased each other

So, there are two separate property estates, each of which would assume that the respective separate heirs or devisees would get an interest. If only Hank has a probate, the PR would sign for his estate (following Probate Path No. 1), and Alice would sign for her mom’s estate (following Probate Path No. 3).

If the probate is closed without the house being sold, then the title company would ask for individual deeds from Wesley, Randi and Alice, with escrow distributing the proceeds of the sale in accordance with mutual instructions from all three.