Each year, approximately 20% of homebuyers fail to protect themselves by not getting owner’s title insurance. Unfortunately, this leaves them exposed to serious financial risk—causing endless worry and regret.

If you’re thinking of buying a home, here’s what you need to know to protect yourself and your property rights, so you can rest assured once you’ve purchased your home.

Looking For Potential Threats

During the home-closing process, your title professional will help transition the home from the seller to you, the homebuyer, by examining public records. Generally, if a problem is discovered, the title professional works to resolve them before you purchase the home.

However, even after a title search is performed and you purchase your home, problems could arise that threaten your ownership rights. Examples include:

- Undiscovered tax liens

- Forged signatures in the chain of title

- Recording errors

- Undisclosed easements

- Title claims by missing heirs* or ex-spouses

Getting owner’s title insurance protects your property rights from threats like these. Here’s a real-life example of how it works.

True Story

A family in Missouri unknowingly purchased their home from a seller who had taken out a separate $419,000 loan on the property. But this fact was not discovered during the closing process, and the family’s lender paid the seller directly instead of paying off the existing loan.

Soon, the family faced foreclosure because someone else had claim against their title. Fortunately, the family had owner’s title insurance. So the title company paid the debt and the family kept their home—and peace of mind.

This story has a positive ending, but without owner’s title insurance, the family could have faced serious costs, and even eviction.

Protect Yourself

There are two types of title insurance: lender’s title insurance and owner’s title insurance.

Lender’s title insurance is required by most lenders and banks because it protects their loan investments. Usually, you purchase this policy as the homebuyer. If you only have a lender’s policy, where the outstanding loan is covered, your equity is not protected. Therefore, you could have your property rights taken away if someone else has claim to your home.

Owner’s title insurance is the policy that protects your property rights from legal and financial threats like those mentioned in the story you just read. That’s why millions of homebuyers each year make the smart decision to get owner’s title insurance. It’s a low, one-time fee that provides the peace of mind that every homebuyer deserves, for as long as you or your family* own your home. In many areas, the seller purchases the policy for you. Ask your title professional how it’s handled in your area.

Support and Free Information

To buy your home with confidence, you need to work with a trusted title professional. They’re the experts who will help you throughout the home closing process. They will also advise you on how to protect your property rights and avoid costly problems by getting owner’s title insurance.

For more information, please contact us.

*This article offers a brief description of insurance coverages, products and services and is meant for informational purposes only. Actual coverages may vary by state, company or locality. You may not be eligible for all of the insurance products, coverages or services described in this article. For exact terms, conditions, exclusions, and limitations, please contact a Ticor Title representative.

Closing on a home can be an exciting and stressful process all at the same time. With so many potential speed bumps it’s important we make your closing flow as smooth as possible. At Ticor we believe one of the easiest ways to accomplish this is by educating buyers and sellers as they prepare for the big day. In particular we’d like to highlight some of the simple steps a buyer/seller can take to expedite the process. We call these steps the “Keys to a Successful Closing”.

Closing on a home can be an exciting and stressful process all at the same time. With so many potential speed bumps it’s important we make your closing flow as smooth as possible. At Ticor we believe one of the easiest ways to accomplish this is by educating buyers and sellers as they prepare for the big day. In particular we’d like to highlight some of the simple steps a buyer/seller can take to expedite the process. We call these steps the “Keys to a Successful Closing”.

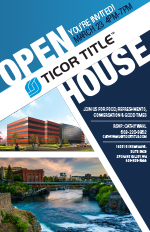

Click here to download the invite

Click here to download the invite