Title to real property may be held in a variety of ways in the state of Washington. And the specific way a vesting is written determinines how title is held. Below are several explanations and examples of the common ways title may be held by individuals or two or more people in Washington State.

ONE SINGLE PERSON

When holding title as a single person, any of the following vestings are acceptable:

When holding title as a single person, any of the following vestings are acceptable:

- John Q. Brown, a single man

- Mary S. Jones, a single individual

- John Q. Brown, an unmarried person

- Mary S. Jones, an unmarried woman

It is acceptable, although unnecessary, to add “as her/her separate estate” to the above vesting.

TWO OR MORE SINGLE PEOPLE

Tenants in Common

When two or more individuals hold title together, they do so as tenants in common, even if the deed does not reflect that (unless the deed creates a joint tenancy). This means that each of the individuals has a separate and distinct claim to some fraction of the ownership involved. The following are examples of acceptable vestings:

- John Q. Brown and Mary S. Jones, both single individuals

- Mary S. Jones, an unmarried woman, and John Q. Brown, an unmarried man

- John Q. Brown, Mary S. Jones and John J. Johnson, all single people, as tenants in common

Then specific amount of ownership can be established by inserting in the vesting the percentage of interest that each of the buyers will hold. An example of this would be:

- Mary S. Jones, a single woman, as to an undivided 75% interest and John Q. Brown, a single man, as to the remaining undivided 25% interest

If no percentage is set-forth, each of the tenants will have a presumed equal percentage.

Joint Tenancy

Joint Tenancy is two or more single individuals as “joint tenants with right of survivorship and not as tenants in common”. This means the joint tenants have agreed that if one of them dies, the other will automatically inherit the deceased person’s interest in the property. To create such an estate, the deed must reflect the above verbiage and should contain the following acknowledgement signed by the buyers:

“The grantee acknowledges that it is their intent to acquire the property described herein as joint tenants with right of survivorship and not as tenants in common.”

An example of vesting is:

- John Q. Brown and Mary S. Brown, a marital community

- John Q. Brown and Mary S. Brown, husband and wife

- Mary S. Brown and John Q. Brown, wife and husband

It is possible for a husband and wife to acquire title as joint tenants with right of ownership rather than community property. However, Washington law does not favor joint tenancy between married persons and it is recommended that you consult an attorney before choosing this vesting.

A MARRIED PERSON AS THEIR SEPARATE ESTATE

When one member of the marital community wants to hold title separately from their spouse, title would be vested as follows:

- Jane Q. Doe, a married woman as her separate estate

This vesting is usually perfected by recording a Quit Claim Deed from the spouse. In the absence of a deed, proof that community funds are not being used for the purchase of the property, or a Decree of Legal Separation with the necessary language establishing separate property would be required. In the event that none of these options are available, the deed can still be recorded with this vesting, but the title company would not be able to insure title in this manner. Instead vesting would be insured as follows:

- John W. Brown, presumptively subject to the community of interest of his spouse.

If financing is being obtained for the purchase, the scenario may not be practical as the lender will probably require that title be perfected in the separate estate as condition to the loan. Automatic homestead laws may also require the execution of deeds and encumbrances by both the spouses if the subject property is their primary residence.

Download a PDF of this article here

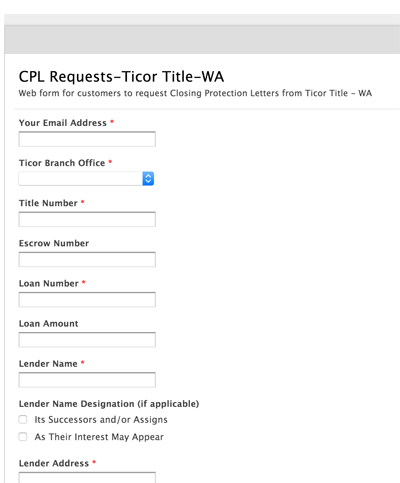

Download a PDF of this article here Ticor Title is proud to introduce a system by which we provide Closing Protection Letters (CPLs) in under one minute for our Lender Clients, providing convenience and a speedy response 24/7. When a Lender completes the CPL request form via MyTicor.com, a response via email with the completed CPL will be sent promptly.

Ticor Title is proud to introduce a system by which we provide Closing Protection Letters (CPLs) in under one minute for our Lender Clients, providing convenience and a speedy response 24/7. When a Lender completes the CPL request form via MyTicor.com, a response via email with the completed CPL will be sent promptly.