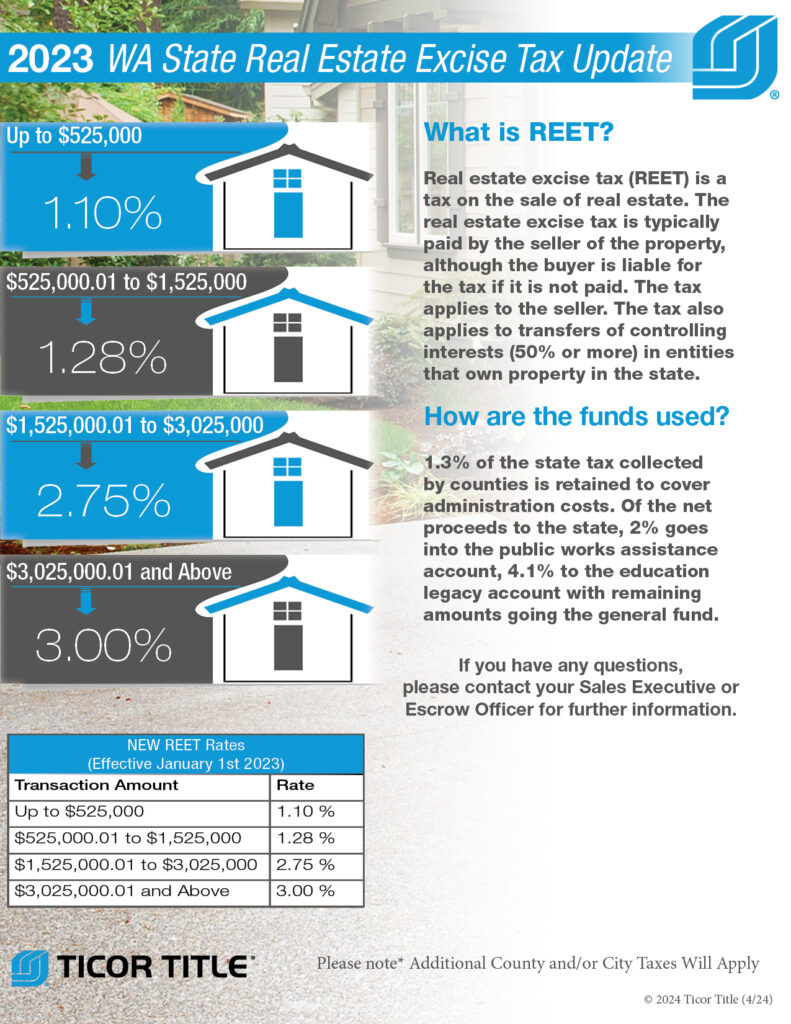

On April 28th, 2019, The Washington State Legislature passed a 2-year budget that will have a significant impact on most sellers of commercial and residential real estate.

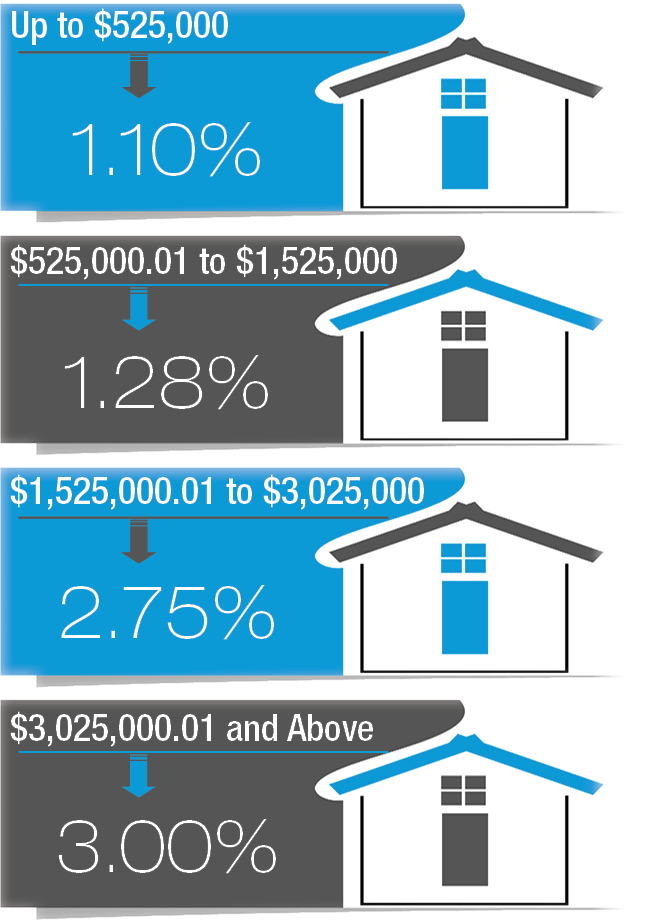

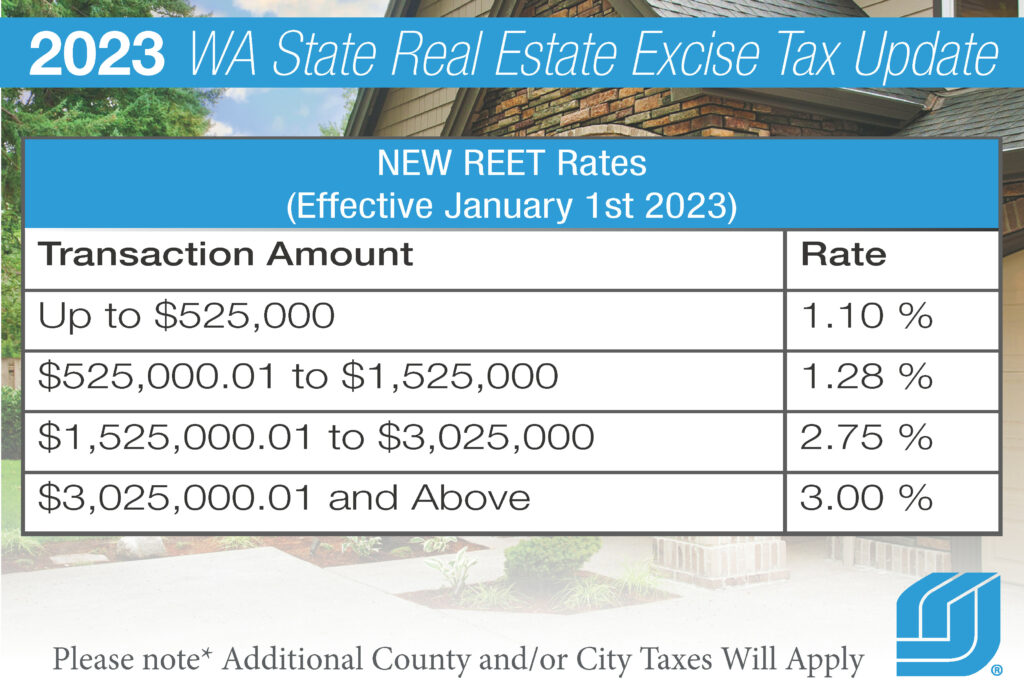

As of January 1st 2023, there was an additional update below.

What is REET?

Real estate excise tax (REET) is a tax on the sale of real estate. The real estate excise tax is typically paid by the seller of the property, although the

buyer is liable for the tax if it is not paid. The tax applies to the seller. The tax also applies

to transfers of controlling interests (50% or more)

in entities that own property in the state.

How are the funds used?

1.3% of the state tax collected by counties is retained to cover administration costs. Of the net proceeds to the state, 2% goes into the public works assistance account, 4.1% to the education legacy account with remaining amounts going the general fund.

Effective Jan. 1, 2020, ESSB 5998 made changes to the real estate excise tax program. Some of these changes include:

- a graduated state REET rate structure for sales of real property

- exception: agricultural land/timberland is excluded from the new rate structure and will continue to have a state REET rate of 1.28%

- updates for controlling interest transfers (greater than 50% change of ownership in an entity that owns real property)

- expands the transfer period from 12 months to 36 months

- changes the reporting requirements during the annual corporate renewal cycle to disclose any transfers 16% or more

Please note* Additional County and/or City Taxes Will Apply

More information is available at the Washington State Department of Revenue https://dor.wa.gov/find-taxes-rates/other-taxes/real-estate-excise-tax

If you have any questions, please contact your Sales Executive or

Escrow Officer for further information.