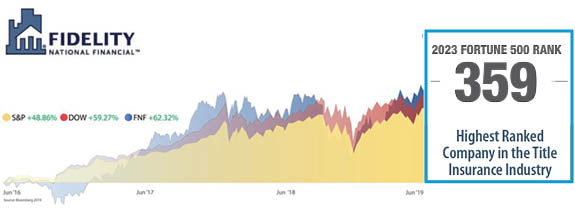

Unrivaled Financial Strength

Fidelity National Financial, Inc. is the parent company to Ticor Title. Being part of the leading provider of title and escrow services in the world gives us the financial strength to issue more title policies than any other title company in the nation. Read more...

Meet The Team

We believe that every successful closing begins with a great team. From open to close, our Title & Escrow team is dedicated to creating a superior client experience by providing clear communication, personalized service, and consistency with every real estate transaction.

Customer Service

Our property information specialists are true professionals and passionate about serving and solving problems for our clients. Reach us any time of the day via email or call our property information hotline to answer any of your questions or inquiries.Latest Articles & Announcements

- We have been voted as the #1 Best Title Company! Thank You from Ticor Title! Read more →

- Happy Labor Day From Ticor Title! Read more →

- Exciting News! Team Ohana has joined Ticor Title! Read more →

- Ticor wishes you a joyful celebration of Independence Day! Read more →

- Welcome Adrian! Read more →

- Welcome Joline! Read more →

Client Recommendations:

Join the thousands of clients who choose Ticor Title

"After working with multiple companies over many years on hundreds of transactions, I can confidently say Ticor is top-notch. Their communication is always fantastic, and their professionalism much appreciated. Beyond just getting files closed, they take the time to and take excellent care of the clients as well."Anon.

Real Estate Broker