A small piece of Lucerne Valley was being sold for $41,000 in an all-cash transaction. The buyer and seller lived out of the area, necessitating the closing documents be mailed out for signature. The vacant land sale went sideways when the escrow officer mailed the documents to the seller and demanded they be signed in the presence of an approved notary.

Closing documents mailed to principals

Tiffany V., an escrow officer with our sister branch in Victorville, was handling a simple all-cash sale transaction. All the closing documents were mailed out to the principals for signing. The buyer sent in his completed paperwork and closing funds. All Tiffany was waiting for, was the seller to send in his completed documents and signed grant deed.

An approved notary must be used

When the seller returned the documents to Tiffany, she discovered the seller had not followed her direction to sign them in the presence of a Company-approved notary. She advised him he would have to re-sign with an approved notary. The seller complained our offices were, “…too far and too inconvenient to get to.” and “This is ridiculous; a notary is a notary.” The seller’s real estate agent even gave Tiffany flack about the seller having to re-sign the conveyance deed. Finally the seller agreed to have a Company-approved notary come to him. The owner of record is Charles S. Calloway and the person the notary was meeting with only had identification for Charles E. Calloway. The seller insisted the notary notarize him just as Charles Calloway and that it would be fine with no middle initial.

The man who signed the documents is not the owner

The notary immediately called Tiffany after meeting with the seller. He informed her that he went ahead and notarized the signer as Charles Calloway without the middle initial to avoid getting into the legalities with him. The notary wanted to make sure, however, that Tiffany knew the Charles Calloway he met with was not the Charles S. Calloway on title, but Charles E. Calloway – the grandson of the owner of record.

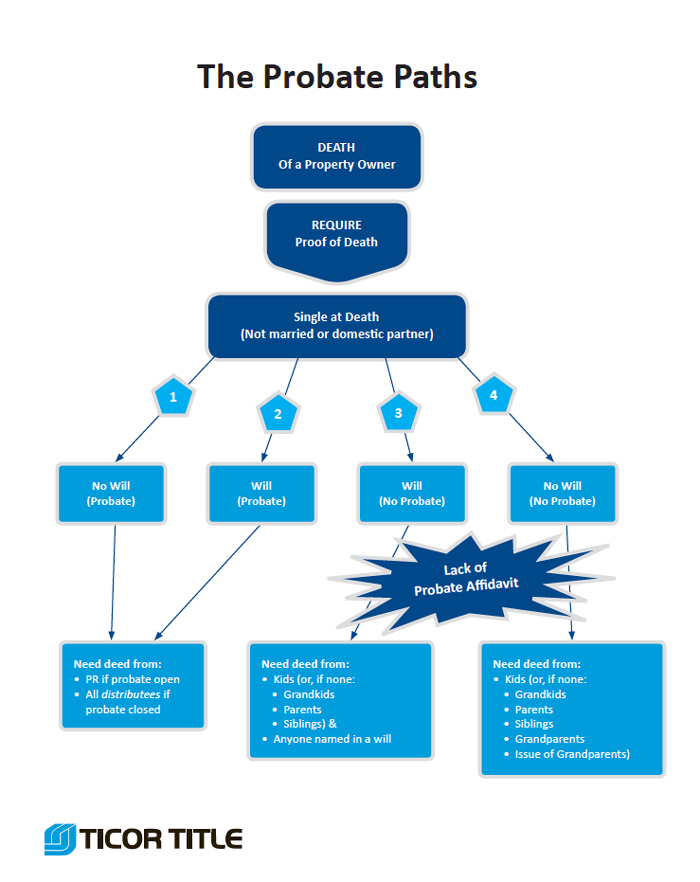

Probates Explained

Probate: Single at Death

Probate: Married, Community Property

Probate: Married, Separate Property

The property had been in the same family since 1938, passed down from father (deceased owner of record) to son (deceased 20+ years) to grandson. The family members apparently never felt they had to transfer title, since they all had the same name of Charles Calloway.Tiffany promptly notified the real estate agents that the seller did not actually own the property. The seller’s agent quickly apologized about the hard time she gave Tiffany over the approved notary requirement and thanked her for catching the situation before it was too late.

…the Charles Calloway he met with was not the Charles S. Calloway on title, but Charles E. Calloway – the grandson of the owner of record.

The agent has put her client in contact with a probate attorney and it appears the buyer is still very interested in the property and is willing to wait for him to go through probate.

The moral of the story

The deed could have been invalidated by the heirs of the estate of Charles Calloway (senior). Since the new owners were purchasing an owner’s title insurance policy, the company would have had to defend them against any claim or loss resulting from the heirs of the estate laying claim to the property or the proceeds from the sale of the property

Mom just passed away, and the family wants to sell the home. This is a listing with a motivated seller. But who actually owns it?

Mom just passed away, and the family wants to sell the home. This is a listing with a motivated seller. But who actually owns it?