Is Title Insurance Optional?

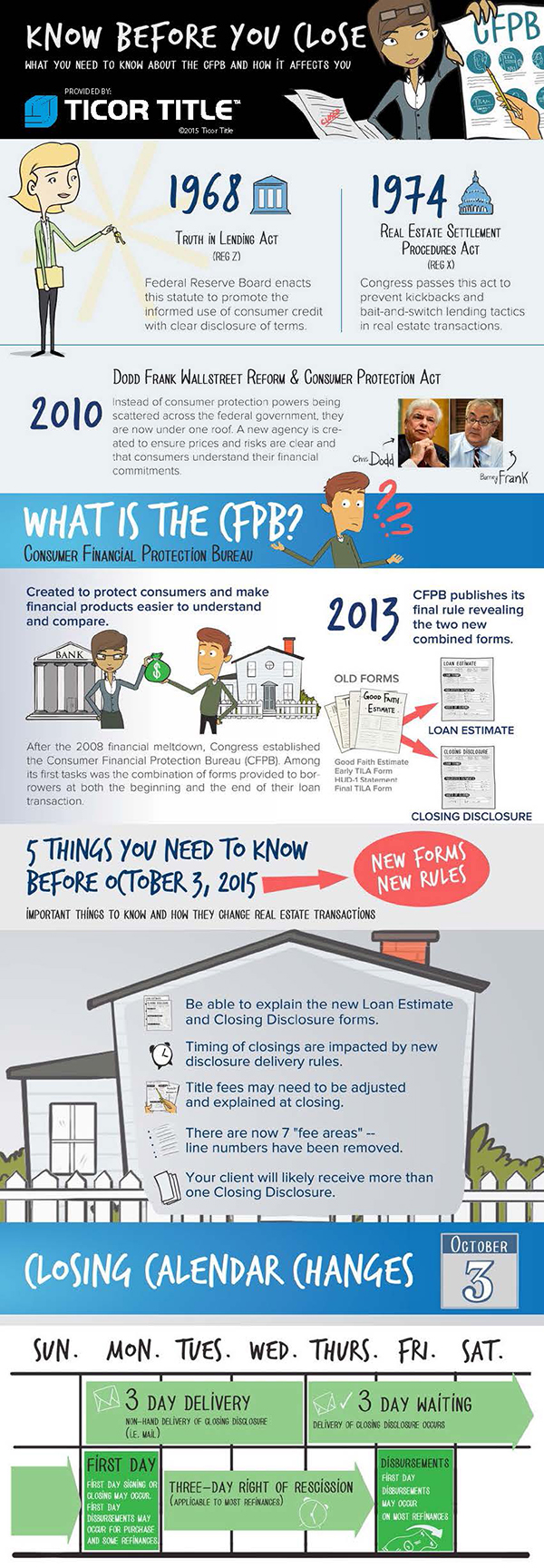

As part of the new CFPB rules, creditors are required to disclose the cost of a Title Insurance policy if it’s the borrower’s responsibility to pay for it. However, the charge must be listed as “optional” on both the Loan Estimate and Closing Disclosure, which might discourage homeowners from buying this protection.

So let’s talk about this word, “optional.” Yes, it’s technically optional, but for most people, owning a home is the biggest investment of their life! Don’t you think they should protect it? And by the way, creditors require their own title insurance policy. That’s how important they think it is to protect their investment.

Protection & Peace of Mind

Related Articles

Which Title Insurance Policy Should I Choose

20 Reasons for Title Insurance

Water Boundaries & Title Insurance

Why Do I Need Title Insurance

Here’s something to consider: Title problems are discovered in more than a third of residential real estate transactions. Over the years, things like liens, easements, and subdivisions cause confusion over who has rights to the property, and the last thing the homeowner wants is drama that puts their investment in jeopardy. But when a consumer has an owner’s Title Insurance policy, these issues are known or resolved before signing on the dotted line, even things that are done illegally or without proper documentation giving borrowers peace of mind that their investment is protected for as long as they own the property.

So there’s our two cents about the value of an Owner’s Title Insurance Policy and listing it as an “optional” expense. The one-time cost for an owner’s title policy is a small price to pay for the peace of mind you gain. And the good news is we’re part of the nation’s largest family of title insurance underwriters, so we’ve got you covered.

To learn more about how the CFPB changes impact you, contact a local representative.